Crypto Whales Explained: What They Are and How They Shape the Market

Summary

What Are Crypto Whales?

Crypto whales are individuals or entities that hold substantial amounts of cryptocurrency, often enough to influence market prices and liquidity. While there’s no universally agreed-upon threshold, holding thousands or even millions of dollars’ worth of digital assets typically qualifies one as a whale. These large holdings allow whales to execute trades that can cause noticeable price movements, making their activities closely monitored by the crypto community.

How Do Crypto Whales Influence the Market?

Credit from ZebPay

1. Price Volatility

Whales can significantly impact cryptocurrency prices through large buy or sell orders. For instance, if a whale sells a large portion of their holdings, it can increase the supply in the market, potentially leading to a decrease in price. Conversely, purchasing a large amount can reduce supply, potentially driving prices up.

2. Market Sentiment

The actions of whales can signal confidence or lack thereof in the market, affecting investor sentiment. Large sell-offs may induce panic among smaller investors, leading to a bearish market, while significant buy orders can create bullish sentiment.

3. Liquidity

If a significant portion of a cryptocurrency is held by whales and not actively traded, it can reduce the asset’s liquidity. This makes it harder for other traders to buy or sell the cryptocurrency without causing significant price changes.

Whale Strategies and Market Manipulation

Credit from CCN.com

Some whales employ strategies that can manipulate the market. By placing large buy or sell orders, they can create artificial price movements, influencing other investors’ behavior. This type of market manipulation is a concern in the crypto space, as it can lead to unfair trading conditions and significant losses for smaller investors.

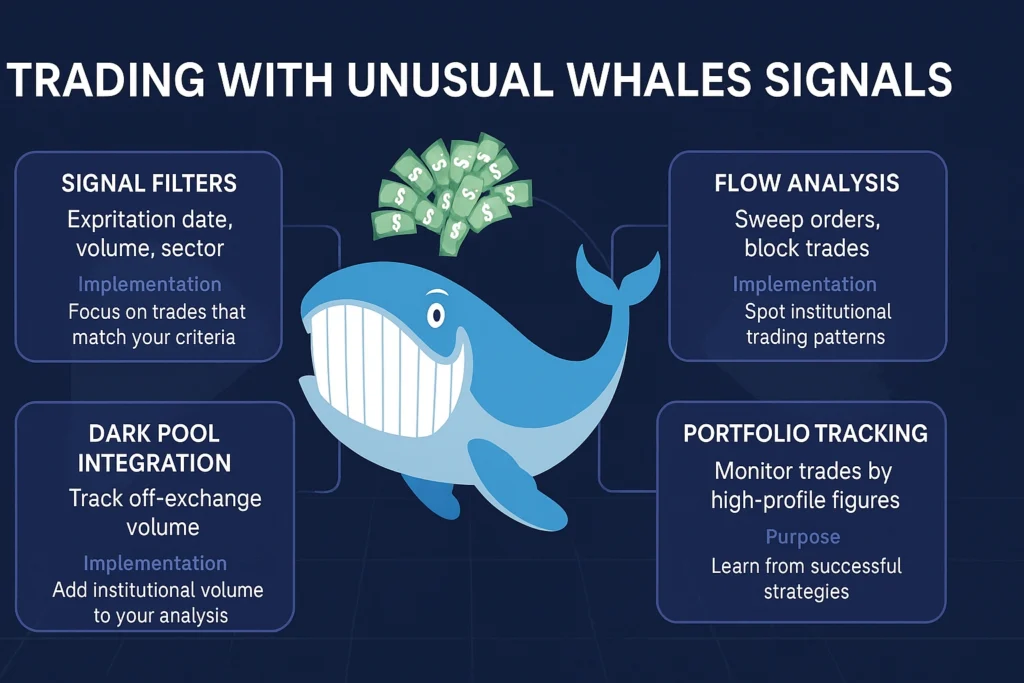

Identifying and Tracking Crypto Whales

Credit from LuxAlgo

Tracking whale activity is crucial for understanding market trends. Several tools and platforms allow investors to monitor large transactions and wallet movements. Platforms like Whale Alert and Whalemap provide real-time data on significant crypto transactions, helping traders stay informed about potential market-moving activities.

Real-World Examples of Whale Activity

In August 2025, a dormant Bitcoin whale moved 80,000 BTC—worth over $8.6 billion—from wallets that had been inactive for 14 years. This unprecedented transfer caused significant market fluctuations and highlighted the potential impact of whale activities on the crypto market.

Additionally, in a recent incident, a whale’s decision to rotate over $2 billion worth of Bitcoin into Ethereum led to a flash crash in Bitcoin’s price, underscoring how whale movements can trigger rapid market changes.

Conclusion

Crypto whales play a pivotal role in the cryptocurrency market. Their large holdings and trading activities can influence prices, liquidity, and market sentiment. Understanding their behavior and tracking their movements can provide valuable insights for investors navigating the volatile crypto landscape.